“Michael, I have a problem.” That’s what Dr. Lopez told me. “My best hygienist is leaving for a corporate dental chain because they offer a 401(k) plan. How do I compete as a small practice?”

I hear this from California doctors and dentists all the time. The solution isn’t paying higher salaries; it is offering benefits that build loyalty, like a 401(k) or IRA.

Why Retirement Plans Are Game-Changers

✅ Employee Contribution Limits: In 2025, staff can contribute up to $23,000/year in a 401(k) (plus $7,500 if age 50+), or $7,000 in an IRA—all pre-tax, lowering their taxable income.

✅ Tax-Deferred Growth: Every dollar invested compounds tax-free until retirement.

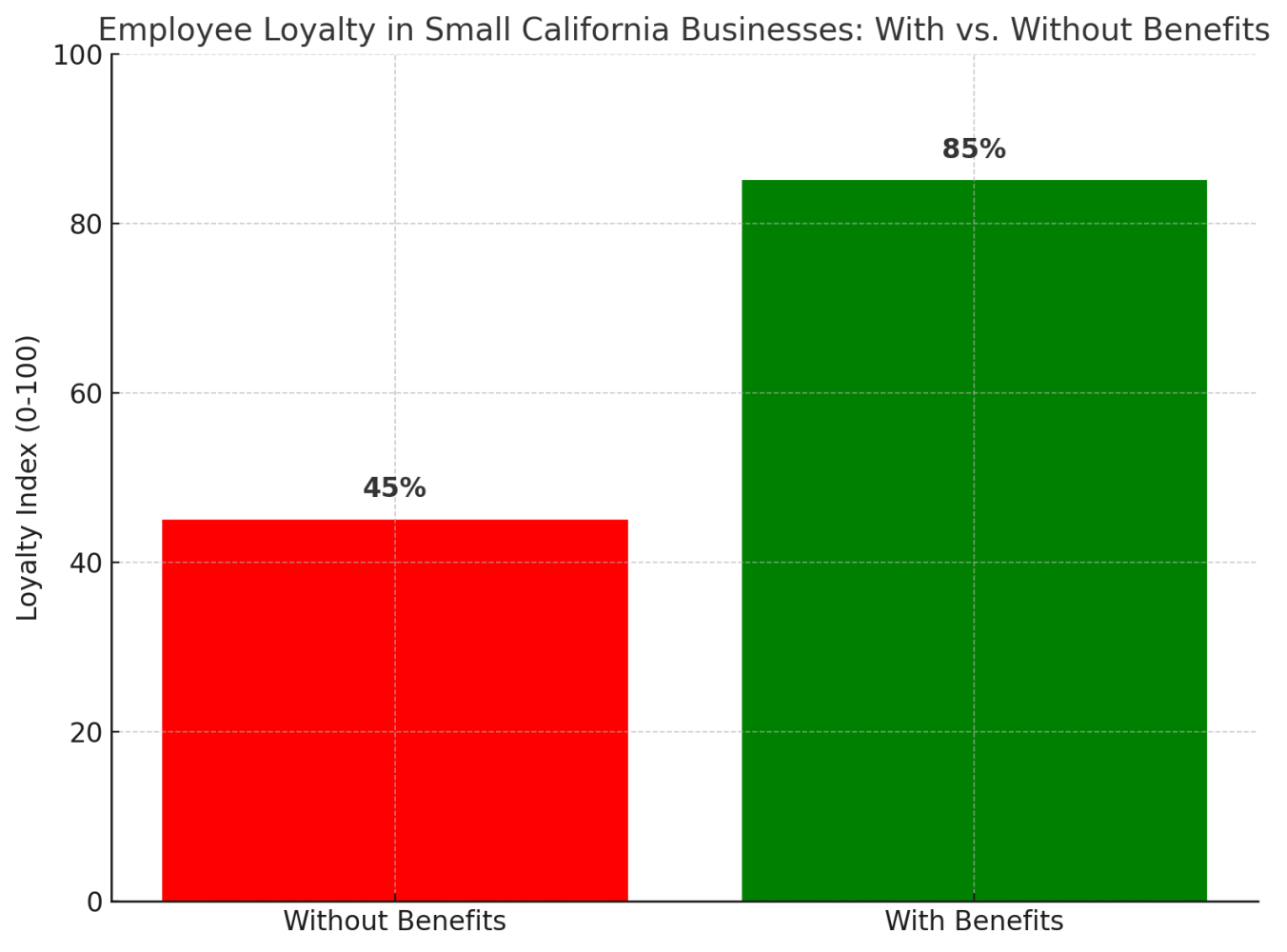

✅ Loyalty Boost: Employees stay where they feel secure. Offering a retirement plan says, “I value your future.”

Owner Benefits You Can’t Ignore

- Tax Deductions: Contributions for employees (and yourself) are fully deductible, slashing your practice’s taxable income.

- Set up Credits: Small businesses qualify for up to $5,000/year in tax credits for three years.

- Your Own Retirement: As owner, you can contribute both as employer and employee, building significant tax-advantaged savings.

- No Mandatory Match: Matching is optional; you control costs. Even a modest match (3%) inspires loyalty.

How This Competes With Big Corporations

Corporate groups use benefits to pull staff from private practices. By offering even a basic 401(k) or IRA, you level the playing field. Your team sees you investing in their future, something money alone can’t buy.

Case 1: Loyalty Without Breaking the Bank

Dr. Lopez set up a 401(k) where employees can contribute up to $23,000 annually (plus a $7,500 catch-up if they’re 50+). She added a modest 3% match, not required, but powerful. ✅ Her team loved it, loyalty skyrocketed, and turnover dropped.

✅ Employees saved pre-tax, growing retirement funds tax-deferred.

✅ Dr. Lopez deducted her contributions, cutting thousands off her taxes.

Case 2: Owner Wins Too

“Michael, I want to save for myself too,” said Dr. Chen, who owns a small 4-employee medical office. We opened a Simple IRA.

✅ Dr. Chen maxed her own contributions, building her retirement fast.

✅ Her employees felt valued, contributing up to $16,000 annually.

✅ She claimed a $5,000 tax credit for starting the plan and deducted contributions, slashing her business taxes.

Why It Works

- Employees: Lower taxable income, tax-deferred growth, and real financial security.

- Owners: Tax deductions, personal retirement savings, and a competitive edge against big hospitals.

- Cost: Setup is low, and matches are optional—you stay in control.

Offering a retirement plan isn’t just about savings; it’s about showing employees you care. That’s what keeps them loyal.

Bottom Line: A retirement plan is a win-win: your employees gain financial security and loyalty rises, while you cut taxes and build your own wealth.

If you’ve ever thought, “Michael, I can’t compete with bigger offices,” think again. The smartest practices in California are using tax-advantaged retirement plans to keep their teams happy and their bottom line strong.

💬 Want to see how a 401(k) or IRA could save you taxes and lock in loyal staff? Let’s talk.