As a dentist, your hands are your livelihood. ✨ You’ve dedicated years of your life and countless dollars to perfect your craft. You’re a financial powerhouse, a business owner, and a healer. But what if one day, you couldn’t practice? A simple slip and fall, a sudden illness, or even repetitive stress from your work could put an end to your career overnight. This isn’t just a financial risk; it’s an emotional and professional one, which happens again and again, even to this author’s family dentist.

The Truth You Can’t Ignore: The “It Won’t Happen to Me” Myth 🎲

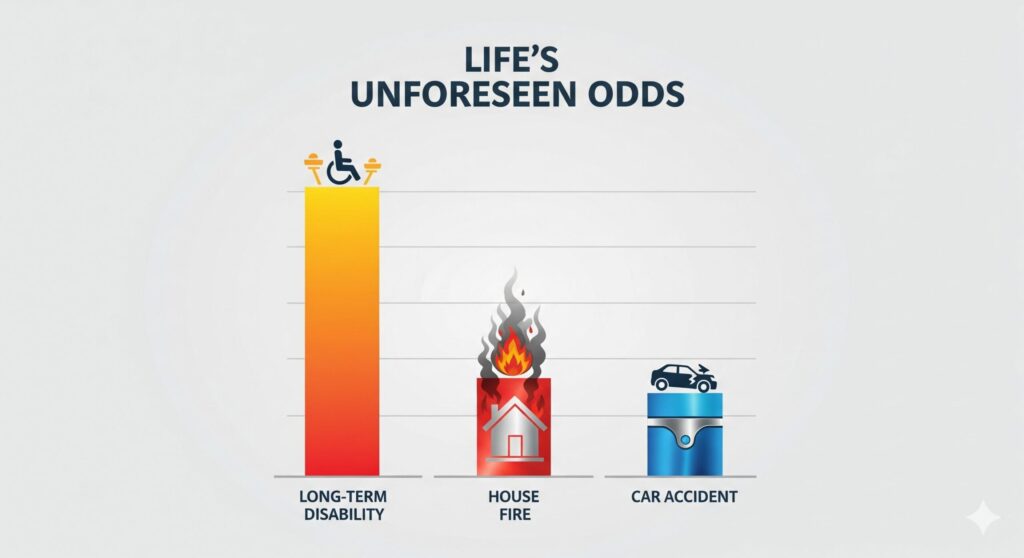

We’re all guilty of it. We think of disability as something that happens to “other people.” But the stats tell a different story. Over 1 in 4 of today’s 20-year-olds will be out of work for at least a year due to a disabling condition before they retire. 🤯 For dentists, the risks are unique and very real. Think about it: the precise, repetitive movements, the awkward postures, the long hours. Carpal tunnels, back pain, and vision problems; these are not just annoyances; they are potential career-enders. Without a safety net, your entire financial world could come crashing down

The Psychology of Security: Sleep Soundly Knowing You’re Protected 😴

Investing in disability insurance isn’t just a financial decision; it’s a psychological one. It’s about buying peace of mind. The human brain is hardwired to fear loss more than it desires gain. The anxiety of losing your practice, your income, and your independence can be overwhelming. A robust disability policy removes that fear, allowing you to focus on your patients and your passion, not on a “what if.” It’s the ultimate act of self-care and professional responsibility.

What Your Policy Needs: The A-Z of Dental Coverage 📋

A standard policy won’t cut it. For dentists, the “true own-occupation” clause is the most essential feature. It means if an illness or injury prevents you from performing the specific duties of your dental specialty, you’re covered—even if you’re able to work in a different, less demanding job. This is non-negotiable!

Key Coverages to Look For:

- Own-Occupation Definition: 🦷 This is your golden ticket. It ensures you’re considered disabled if you can’t be a dentist, not just if you can’t work at all.

- Partial/Residual Benefits: If you can still work part-time but with a reduced income, this rider helps fill the gap.

- Future Increase Option (FIO): As your income grows, this lets you increase your coverage without new medical exams. A must-have for young dentists!

- Cost of Living Adjustment (COLA): This rider helps your benefits keep up with inflation during a long-term disability.

- Non-Cancellable & Guaranteed Renewable: Your policy is locked in, and your rates won’t go up (unless you add riders). This is true security.

Top 5 Insurance Companies for Dentists 🏆

When it comes to protecting your career, you need the best. These companies are consistently recommended for their strong financials and specialty-specific policies:

- Guardian: A true leader in “own-occupation” coverage for professionals. A gold standard.

- Principal: Known for its flexible plans and strong policies tailored to high-income earners.

- MassMutual: Offers excellent financial stability and customizable policies with strong riders.

- Ameritas: A great choice, especially for newer dentists, with solid “own-occupation” and future-proof options.

- Ohio National Financial Services: A reliable and competitive option with a focus on comprehensive coverage.

Remember, always work with an independent advisor to find the perfect policy for you. 🤝

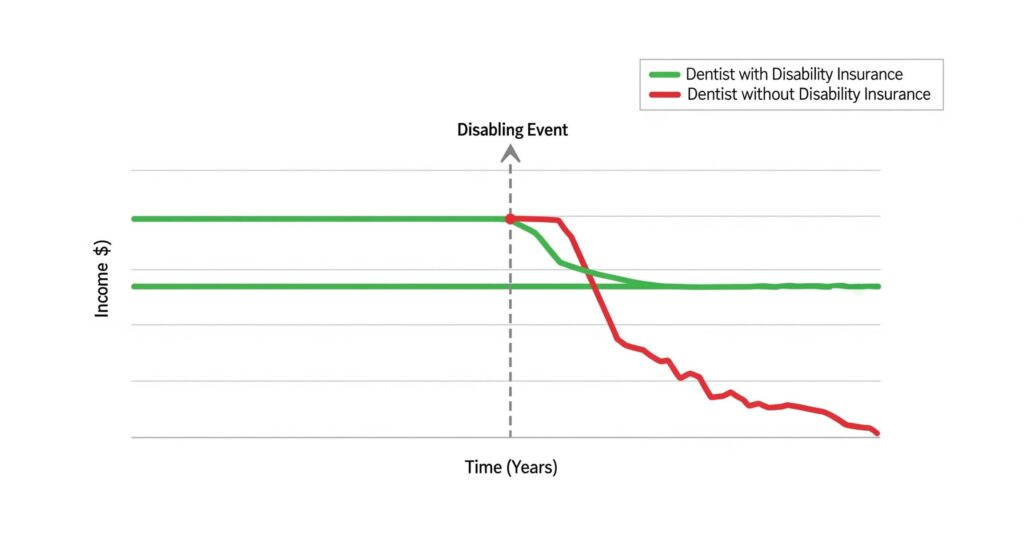

The Tale of Two Dentists: A Powerful Lesson ⚖️

Scenario 1: Dr. Jessica Lee – Prepared and Resilient 💪

Dr. Lee, an endodontist, had a comprehensive disability policy. After a sudden nerve disorder made her hands unsteady, she couldn’t perform root canals anymore.

- Her Policy: Kicked in with a “true own-occupation” benefit, replacing most of her income.

- Outcome: Dr. Lee used the financial security to focus on her health. She eventually transitioned into a successful teaching position at a dental school, all while continuing to receive her full disability benefits. She never had to worry about her bills or losing her home.

Scenario 2: Dr. Mike Rodriguez – The High-Stakes Gamble 📉

Dr. Rodriguez believed he was too healthy for disability insurance. A terrible car accident left him with a severe back injury, making the physical demands of his practice unbearable.

- His Gamble: He had no personal policy, only a limited group plan that defined disability as the inability to work “any” job.

- Outcome: The insurance company denied his claim, arguing he could still work as a dental consultant or in a low-paying administrative role. With no income, his practice folded, and he lost his life savings. The stress led to further health issues.

Don’t Become a Statistic. Act Now. 💡

The average age of a dentist’s career is over 40 years. That’s a long time for life to throw curveballs. The likelihood of a disabling event is far greater than we think.

Don’t wait for a crisis to realize the value of this coverage. Protect your most valuable asset—your ability to earn a living—and secure the financial future you’ve worked so hard to build. 🤝

Ready to protect your practice and your peace of mind?

For a personalized consultation and a complimentary quote on the right disability insurance for your dental career in Los Angeles and California, please get in touch with me today.

#DentistDisability #ProtectYourFuture #IncomeProtection #OwnOccupation #FinancialWellness #DentistLife #DentalPractice #LosAngelesDentists #CaliforniaDentists #SecureYourFuture

#DentalInsurance #DentistFinance #SecureYourIncome #DisabilityBenefits #FinancialPlanningForDentists 📞✉️💻