Sun Insurance & Financial

🌐 SunInsurance.us

📞 Telephone: (310) 860-5000

TABLE OF CONTENTS

- Introduction

- What Is Fiduciary Liability Insurance?

- Why Fiduciary Liability Insurance Exists

- What Does Fiduciary Liability Insurance Cover?

- Who Needs Fiduciary Liability Insurance?

- Why ERISA Makes Fiduciary Liability Unavoidable

- Most Common Fiduciary Liability Lawsuits

- Real Scenarios & Claims With Outcomes

- In-Depth Coverage Breakdown

- Exclusions: What’s Not Covered

- Comparison Table: Fiduciary vs. D&O vs. EPLI

- How Much Does Fiduciary Liability Insurance Cost?

- How Long Do Lawsuits Last?

- Why Fiduciary Lawsuits Are Increasing

- Most Common Mistakes That Lead to Claims

- How Employers and Advisors Reduce Risk

- Frequently Asked Questions (Q&A)

- Why Sun Insurance & Financial Is the Best Choice

- Final Recommendations

- Contact Information

1. Introduction

Fiduciary Liability Insurance: Managing employee benefit plans is one of the most significant responsibilities a business or professional can undertake. Whether the plan is a 401(k), pension, ESOP, group health plan, disability benefits, or a profit-sharing plan, the individuals responsible for overseeing it are legally considered fiduciaries. This means they must act solely in the best interest of plan participants.

A fiduciary who makes a mistake, forgets a regulatory disclosure, chooses an inappropriate investment lineup, or simply communicates unclear or incorrect benefit details can face:

- Personal liability

- Professional liability

- Class-action lawsuits

- Regulatory enforcement

- Financial damages

- Loss of reputation

- Severe legal fees

And here’s the part most professionals don’t know:

👉 Fiduciaries can be held personally responsible — even if they did not intentionally cause harm.

Even a minor administrative error can lead to massive legal consequences.

That is why Fiduciary Liability Insurance is considered one of the most essential forms of protection for businesses, financial advisors, investment advisors, attorneys, HR leaders, and any executives involved in benefit plans.

This guide will walk you through everything you need to know — without confusing jargon — and give you a complete understanding of why this coverage is critical.

2. What Is Fiduciary Liability Insurance?

Fiduciary Liability Insurance protects businesses and individuals who manage or advise on employee benefit plans against claims alleging mismanagement, breach of fiduciary duty, administrative errors, improper advice, or failure to act in the best interest of plan participants.

It covers:

- Legal defense costs

- Settlements

- Judgments

- Investigation costs

- Administrative mistakes

- Violations of fiduciary responsibility

- Failure to monitor third-party administrators

- Employee lawsuits connected to benefit plans

Variation keywords incorporated naturally:

- fiduciary liability coverage

- fiduciary responsibility insurance

- ERISA fiduciary liability

- employee benefit plan liability coverage

- trustee liability insurance

- plan administrator liability insurance

- benefit plan management insurance

This insurance protects the business entity and the individuals responsible for benefit plan oversight.

3. Why Fiduciary Liability Insurance Exists

Fiduciary duty is one of the strictest obligations under federal law. When an employer offers benefits such as retirement plans or health coverage, the business becomes a fiduciary — and is legally obligated to:

- Act solely in the best interest of participants

- Avoid conflicts of interest

- Make decisions prudently

- Follow plan documents

- Monitor service providers

- Keep fees reasonable

- Ensure accurate communications

Failure in any of these areas can lead to:

- Employee lawsuits

- Regulatory investigations

- Claims of financial harm

- Class-action litigation

- Personal liability for executives and advisors

Fiduciary Liability Insurance exists because regular business insurance does not cover these risks.

4. What Does Fiduciary Liability Insurance Cover?

Below is a complete breakdown of coverage, written simply and clearly.

✔ Administrative Errors & Omissions

Most lawsuits are triggered by simple errors:

- Enrollment mistakes

- Missed deadlines

- Incorrect benefit calculations

- Payroll contribution errors

- Wrong plan information

- Failure to update records

- Using outdated benefit booklets

- Incorrectly denying a claim

Fiduciary Liability Insurance covers the financial consequences.

✔ Breach of Fiduciary Duty

This includes accusations that a fiduciary:

- Acted imprudently

- Failed to act in participants’ best interests

- Did not diversify investments

- Selected high-fee funds

- Failed to monitor investment performance

- Allowed unreasonable administrative fees

✔ Misrepresentation or Bad Communication

If an employer provides unclear, misleading, or incorrect benefit information, employees can sue.

Examples include:

- Stating a benefit exists when it does not

- Not explaining eligibility rules

- Incorrectly describing matching contributions

- Improperly explaining plan changes

✔ Improper Investment Advice

If employees believe the investment lineup was unsuitable, negligent, or poorly monitored, they can claim financial harm.

This includes:

- Bad fund selection

- Excessive fees

- Lack of diversification

- Failure to change underperforming options

✔ Failure to Monitor Third-Party Administrators

Even when employers outsource recordkeeping or investment services:

👉 The employer still retains fiduciary responsibility.

The employer can be sued for failing to monitor:

- Recordkeepers

- TPAs

- Investment advisors

- Consultants

- Trustees

✔ Legal Defense Costs

Legal defense alone can cost more than the actual settlement. This coverage pays for:

- Attorneys

- Discovery

- Mediation

- Expert witnesses

- Court appearances

✔ Settlements & Judgments

If the employer or fiduciary loses the case or settles, the policy covers:

- Settlement payments

- Court-ordered compensation

- Financial losses attributed to errors

5. Who Needs Fiduciary Liability Insurance?

Anyone who manages, oversees, or advises on employee benefit plans needs this coverage.

✔ Financial Industry

- Financial advisors

- Investment advisors

- Registered Investment Advisors (RIAs)

- Wealth managers

- Pension consultants

- 401(k) plan advisors

- Retirement planners

- Broker-dealers who oversee benefit plans

- ESOP consultants

- Portfolio advisors

✔ Legal & Professional Services

- Attorneys

- ERISA lawyers

- Trust administrators

- Professional fiduciaries

- Law firms offering benefits

✔ Corporate Executives & HR Teams

- CEOs

- CFOs

- COOs

- Controllers

- Board members

- HR directors

- Benefits managers

- Plan administrators

- Plan committee members

✔ Businesses Offering Benefits

Any business offering:

- 401(k)

- 403(b)

- Pension plans

- ESOPs

- Group health plans

- Group life or disability benefits

- Profit-sharing plans

- Cafeteria plans

needs fiduciary liability coverage — regardless of size or industry.

6. Why ERISA Makes Fiduciary Liability Unavoidable

Federal law imposes strict standards on benefit plan fiduciaries. A fiduciary can be personally sued even for:

- Good-faith mistakes

- Innocent oversights

- Clerical errors

- Third-party administrator errors

- Miscommunication

- Misinformation

- Inaccurate statements

Personal assets such as:

- Savings

- Homes

- Investments

- Retirement accounts

can be targeted in lawsuits unless fiduciaries have proper coverage.

7. Most Common Fiduciary Liability Lawsuits

Here are the most frequent categories:

✔ Investment mismanagement claims

Employees argue the plan’s investments were poorly chosen or monitored.

✔ Excessive fee lawsuits

Claiming investment or administrative fees are too high.

✔ Administrative error lawsuits

Incorrect benefit calculations or denied coverage.

✔ Misrepresentation lawsuits

Incorrect descriptions of retirement benefits or health plans.

✔ Enrollment mistakes

Employees not enrolled on time.

✔ ESOP valuation disputes

Incorrect valuation of company stock.

✔ Improper plan amendment claims

Employees argue that plan changes were unlawful or improperly communicated.

8. Real Scenarios & Outcomes

SCENARIO 1 — Investment Mismanagement

A company’s retirement committee fails to monitor fund performance for several years.

Outcome:

Class-action lawsuit

Total cost: approximately $850,000

Fiduciary Liability Insurance covered legal defense and settlement.

SCENARIO 2 — Late Enrollment

An HR manager forgets to enter new employees into health coverage on time.

A dependent suffers a medical emergency and coverage is denied.

Outcome:

Employee sues for damages.

Insurance covers defense plus settlement.

SCENARIO 3 — Incorrect Match Statement

A memo states the company matches up to 6% of contributions, but the real match is 3%.

Outcome:

Employees sue collectively.

Insurance covers compensation and attorney fees.

SCENARIO 4 — ESOP Valuation Error

Incorrect valuation leads to workers being underpaid for shares.

Outcome:

Shareholders sue the employer.

Policy covers legal defense and settlement.

SCENARIO 5 — Failure to Monitor a TPA

The third-party administrator made contribution mistakes, but employees sue the employer.

Outcome:

Employer held responsible.

Fiduciary Liability Insurance covers the claim.

9. Coverage Breakdown (Detailed)

| Coverage Type | Included? | Explanation |

|---|---|---|

| Administrative Errors | ✔ | Covers mistakes in plan management |

| Breach of Fiduciary Duty | ✔ | Protects against ERISA claims |

| Investment Mismanagement | ✔ | If fiduciaries oversee investment options |

| Improper Advice | ✔ | Covers negligent recommendations |

| Communication Errors | ✔ | Misleading or incorrect benefit details |

| TPA Monitoring Failures | ✔ | Employer is still responsible |

| Defense Costs | ✔ | Attorney fees, court costs |

| Settlements & Judgments | ✔ | Payment to employees or participants |

| Fraud | ✘ | Never covered |

| Criminal Acts | ✘ | Excluded |

| Intentional Harm | ✘ | Excluded |

10. Comparison Table: Fiduciary vs. D&O vs. EPLI

| Feature | Fiduciary Liability Insurance | D&O Insurance | EPLI |

|---|---|---|---|

| Protects retirement plans | ✔ | ✘ | ✘ |

| Protects health/benefit plans | ✔ | ✘ | ✘ |

| Covers plan mismanagement | ✔ | ✘ | ✘ |

| Covers employee lawsuits | ✘ | ✘ | ✔ |

| Covers claims against directors | Limited | ✔ | ✘ |

| Covers HR decisions | ✘ | ✘ | ✔ |

| Covers ERISA issues | ✔ | ✘ | ✘ |

11. Cost of Fiduciary Liability Insurance

Premiums depend on:

- Number of employees

- Total plan assets

- Types of benefit plans

- Industry

- Claims history

- ESOP or pension involvement

Typical cost ranges:

- Small businesses: moderate annual premium

- Mid-size businesses: variable depending on benefit complexity

- Large corporations: higher due to greater exposure

Even at the high end, fiduciary liability coverage is considered affordable compared to the catastrophic cost of lawsuits.

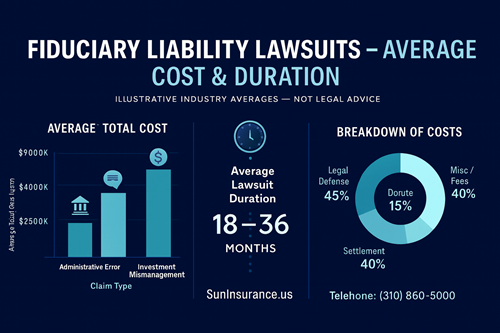

12. How Long Do Lawsuits Last?

Fiduciary lawsuits often take:

- Many months to investigate

- Additional time for legal discovery

- Time for negotiation or mediation

- Extended litigation if settlement is not reached

A full lawsuit can extend across multiple phases, each involving legal fees and administrative work.

13. Why Fiduciary Lawsuits Are Increasing

- Rising employee awareness

- Greater complexity in benefit plans

- More class-action law firms targeting employers

- Confusion around plan fees

- Market volatility affecting retirement balances

- Increased regulatory scrutiny

14. Most Common Fiduciary Mistakes

- Not reviewing investment options regularly

- Not documenting fiduciary decisions

- Poor communication

- Administrative errors

- Failure to monitor vendors

- Incorrect matching contributions

- Using outdated plan documents

- Making subjective decisions without process

15. How Employers and Advisors Reduce Risk

- Conduct annual plan reviews

- Use documented processes

- Provide clear communication

- Maintain correct plan data

- Monitor third-party vendors

- Train HR teams

- Purchase Fiduciary Liability Insurance

16. Frequently Asked Questions (Q&A)

Q1: Is Fiduciary Liability Insurance required by law?

No, but fiduciaries are personally liable without it.

Q2: Does D&O Insurance cover fiduciary claims?

No.

Q3: Does EPLI replace fiduciary coverage?

No — they protect completely different risks.

Q4: Does this insurance cover ERISA penalties?

Many policies offer limited protection.

Q5: What happens if my TPA makes a mistake?

You are still liable — but insurance protects you.

17. Why Sun Insurance & Financial Is the Best Choice

Sun Insurance & Financial specializes in:

- Retirement plan risks

- Fiduciary duty risks

- Business liability coverage

- Professional liability risks

- Employee benefit plan insurance

We provide personalized consultations for:

- Financial advisors

- Investment advisors

- Law firms

- Medical and dental offices

- Corporations

- Nonprofits

- Small businesses

Our goal is to protect your business and your personal assets from unexpected legal exposure.

18. Final Recommendations

Every business, advisor, and fiduciary should secure Fiduciary Liability Insurance to protect against mismanagement claims, administrative mistakes, and ERISA-related lawsuits.

The risks are too large to ignore — and the cost of protection is far smaller than the cost of a claim.

19. Contact Information

Sun Insurance & Financial

🌐 SunInsurance.us

📞 Telephone: (310) 860-5000

We will help you secure the right Fiduciary Liability Insurance policy to safeguard your business, your employees, your plan participants, and your personal assets.

Sun Insurance and Financial https://SunInsurance.us

Travelers Insurance

The Hartford Insurance

California Fair Plan Insurance

Hiscox Insurance