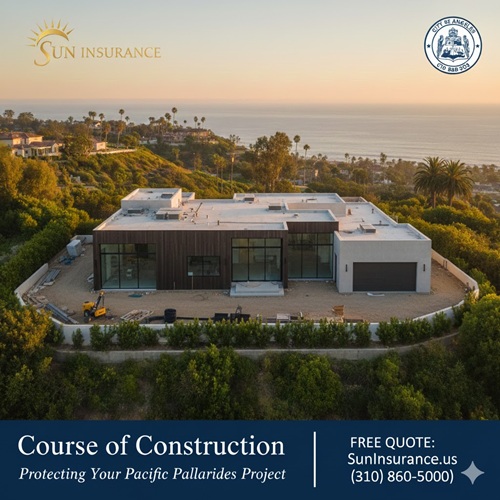

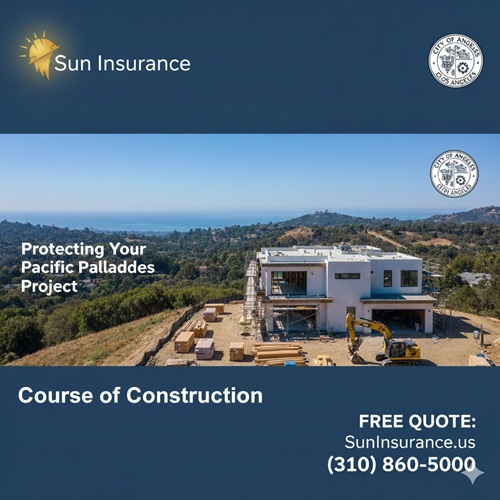

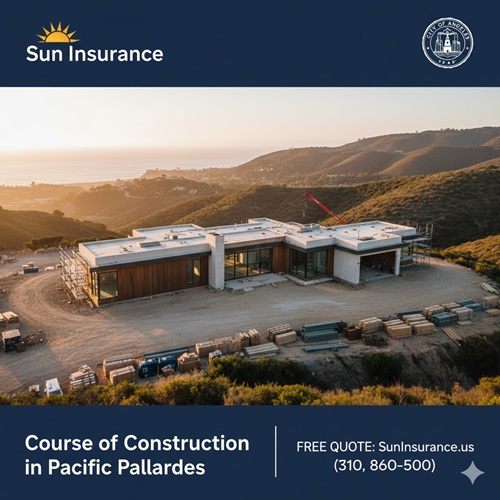

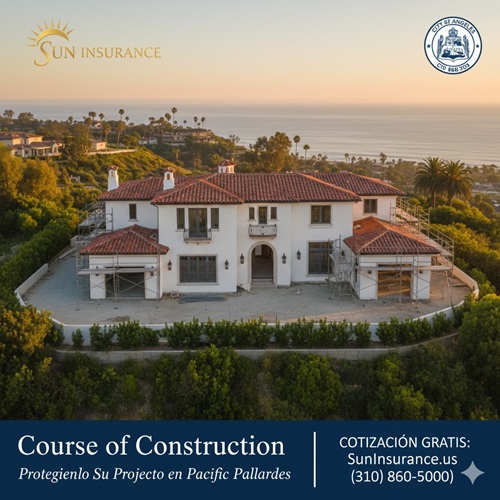

Course of Construction Insurance in Pacific Palisades, CA: Pacific Palisades, CA, is one of the most desirable coastal residential communities in Los Angeles. From multimillion-dollar rebuilds to hillside renovations and new luxury homes near Sunset Boulevard, property development in Pacific Palisades continues to grow. With that growth comes a powerful need for Course of Construction Insurance in Pacific Palisades, CA—a critical policy that protects homes under construction, remodeling, or reconstruction.

Whether you’re a homeowner building your dream residence, a developer taking on a new investment project, or a contractor overseeing multiple builds, construction carries risks—fires, theft, vandalism, weather, structural collapse, liability, and more. That is why Course of Construction (COC) Insurance—commonly known as Builder’s Risk Insurance—is one of the most essential coverages in the area.

This comprehensive 4000-word guide explains EVERYTHING you need to know about Course of Construction Insurance in Pacific Palisades, CA, including what it covers, who needs it, how it works, cost factors, alternatives, and scenarios showing real-life outcomes.

📚 Table of Contents

- Introduction to Course of Construction Insurance in Pacific Palisades, CA

- Why Construction Projects in Pacific Palisades Carry Higher Risk

- What Course of Construction Insurance Covers (Full Breakdown)

- Who Needs COC Insurance in Pacific Palisades?

- Common Exclusions

- Cost of Course of Construction Insurance in Pacific Palisades

- Scenarios & Real-Life Outcomes

- Comparison Table: COC vs Homeowners vs Contractor Policies

- Frequently Asked Questions (Q&A)

- How to Lower Your COC Premium

- Why Choose Sun Insurance & Financial

- Contact Information

🏗️ 1. Introduction to Course of Construction Insurance in Pacific Palisades, CA

Course of Construction Insurance in Pacific Palisades, CA, is a specialized insurance policy designed to protect residential or commercial building projects during construction, renovation, or reconstruction.

In a coastal city like Pacific Palisades—where homes sit near wildfire zones, mudslide-prone hillsides, canyon winds, and high-value neighborhoods—the stakes are higher than average.

COC Insurance ensures that:

- If a fire damages the structure mid-project…

- If materials are stolen from the job site…

- If a storm causes water intrusion during framing…

- If vandalism causes thousands in damage…

…you are financially protected.

Unlike standard homeowners insurance, which does not cover major renovations or new builds, COC Insurance is a specialty product that fills these gaps.

🔥 2. Why Construction Projects in Pacific Palisades, CA Carry a Higher Risk

Pacific Palisades is a breathtaking but risk-sensitive region. The combination of coastal conditions, canyon geography, and hillside terrain means construction projects face elevated exposure.

Here are the primary hazards affecting construction sites in the area:

2.1 Wildfire Risk

⚠️ The Palisades Brush Fire zone, Temescal Canyon, and Topanga Canyon are high-risk wildfire areas. Construction sites are particularly vulnerable because:

- No finished fire-resistant structure

- Exposed materials

- Temporary power sources

- Lack of enclosed sprinkler systems

This makes wildfire damage one of the biggest threats.

2.2 Coastal Wind Exposure

Windstorms near Palisades Bluffs, Via de la Paz, and Will Rogers State Beach can topple scaffolding, knock debris into structures, and blow away materials.

2.3 High Construction Costs

Labor and materials in the Los Angeles Westside are among the highest in the United States. Any loss during construction becomes extremely expensive.

2.4 Theft & Vandalism

Luxury construction sites are prime targets for:

- Copper wire theft

- Power tool theft

- Appliance theft

- Vandalism for vacant structures

2.5 Mudslides & Ground Movement

Canyon and hillside lots in Pacific Palisades are exposed to:

- Mudslides

- Soil movement

- Heavy rain damage

All of these risks make Course of Construction Insurance in Pacific Palisades, CA, essential.

🛡️ 3. What Course of Construction Insurance Covers

Below is a complete coverage breakdown, written in clear, easy-to-understand language.

✔️ 3.1 Property Damage to the Structure

COC covers property damage to the building while it is being:

- Built

- Renovated

- Expanded

- Reconstructed

This includes:

- Fire

- Explosion

- Wind damage

- Vandalism

- Vehicle impact

- Falling objects

- Accidental damage

✔️ 3.2 Materials, Fixtures & Supplies

COC covers materials:

- On-site

- In transit

- Stored off-site

Examples:

- Lumber

- Drywall

- Windows

- Doors

- Roofing

- Cabinets

- Flooring

- Appliances

If thieves steal $60,000 worth of high-end appliances? Covered.

If a shipment of $20,000 in windows is damaged during delivery, what happens? Covered (depending on policy structure).

✔️ 3.3 Temporary Structures

Includes:

- Scaffolding

- Temporary fencing

- Sheds

- Trailers

- Concrete forms

✔️ 3.4 Soft Costs (Optional Rider)

These are additional expenses that arise because construction is delayed:

- Architectural fees

- Engineering fees

- Financing charges

- Legal fees

- Permit reapplications

✔️ 3.5 Debris Removal

If a loss occurs, the cleanup costs are covered.

✔️ 3.6 Testing Coverage

For mechanical, plumbing, and electrical systems.

🚫 4. Common Exclusions

Builders Risk / COC policies do not typically cover:

- Earthquake (must be added separately)

- Flood (must be added separately)

- Employee theft

- Wear and tear

- Faulty artistry

- Faulty design

- Contractor equipment

In Pacific Palisades, adding earthquake and water damage riders is strongly recommended due to hill movement and storms.

🧑🔧 5. Who Needs Course of Construction Insurance in Pacific Palisades, CA?

COC Insurance is essential for:

5.1 Homeowners

If you are building or renovating a house costing $400,000 to $25 million, you MUST have COC insurance.

Home insurance will not cover:

- Major remodels

- New construction

- Additions

- Structural changes

5.2 Real Estate Investors

Especially for:

- Flips

- Tear-downs

- Rebuilds

- Luxury resale projects

5.3 General Contractors & Builders

Many lenders require contractors to carry a COC.

5.4 Developers

Speculating or custom-built projects need coverage from the ground up.

5.5 Lenders

Banks will not release construction funds unless the COC is in place.

💰 6. Cost of Course of Construction Insurance in Pacific Palisades

The cost varies based on:

- Project value

- Materials used

- Length of construction

- Location

- Security on site

- Fire protection level

- Height of the structure

- Contractor experience

Average Cost in Pacific Palisades, CA

| Values in Pacific Palisades are higher due to wildfire exposure and high-value builds. | |

|---|---|

🎭 7. Scenarios & Outcomes

Here are real-world scenarios showing how Course of Construction Insurance works.

🧱 Scenario 1 — Home Under Renovation Burns Down

A $4.5 million renovation project in Pacific Palisades Highlands suffered an electrical fire during framing, caused by temporary wiring.

With COC Insurance:

- $4.5 million in structural damage: Covered

- $390,000 in debris removal: Covered

- $60,000 in appliances destroyed: Covered

- New architectural fees: Covered under soft costs rider

Without COC Insurance:

The homeowner pays the full loss because the homeowner’s insurance denies the claim.

🛠️ Scenario 2 — Theft of Materials

A hillside project near Sunset Blvd. loses:

- Copper wiring

- Tools

- New windows

- HVAC equipment

Total loss: $85,000

COC reimburses materials, not contractor personal tools.

🌧️ Scenario 3 — Rainstorm Damages Exposed Framing

During heavy rainfall:

- Framing absorbs water

- Subfloor warps

- Drywall stock ruined

Total damage: $140,000 — fully covered.

🚛 Scenario 4 — Delivery Accident

A truck backs into the partially built structure.

Damage: $52,000 — covered.

🔥 Scenario 5 — Wildfire Ember Storm

Wildfire embers damage materials and framing.

COC covers:

- Scorch damage

- Rebuild cost

- Material replacement

📊 8. Coverage Comparison Table

COC vs Homeowners vs Contractors Insurance

| Type: Course | Construction, Homeowners Policy, Contractors, Frequently Asked Questions | ||

|---|---|---|---|

Q1: Is a COC required for renovations over $50,000?

Yes. Lenders will require it. Homeowners must also carry it, as homeowners’ policies exclude major structural renovations.

Q2: Does COC include liability?

No. Liability is separate. You need a General Liability or Contractor Liability policy.

Q3: How long does a COC policy last?

Typically:

- 6 months

- 12 months

- 18 months

Can be extended.

Q4: Does it cover subcontractors?

The general contractor must list them, or each subcontractor must carry separate coverage.

Q5: Can I add Earthquake Coverage?

Yes — and highly recommended in Pacific Palisades.

💡 10. How to Lower Your Course of Construction Insurance Premium

Here are proven strategies:

- Add a monitored security system

- Use fire-resistant materials

- Keep the construction timeline tight

- Hire experienced contractors

- Store materials securely

- Install temporary fencing

- Show strong financials to the carrier

Sun Insurance and Financial helps negotiate lower premiums using specialized carriers.

🌟 11. Why Choose Sun Insurance & Financial

Sun Insurance & Financial is one of the most experienced insurance agencies in California for high-value construction, renovation coverage, and builder’s risk protection.

✔️ Local Westside knowledge

✔️ Understanding of Pacific Palisades construction exposures

✔️ Access to premium carriers

✔️ Personalized service

✔️ Fast underwriting

✔️ Competitive rates

✔️ Ability to bundle additional coverages

✔️ Experience with high-value homeowners

They guide you from application to project completion.

📞 12. Contact Sun Insurance & Financial

Pacific Palisades: Why This Coastal Community Requires Stronger Construction Protection

Building or renovating property anywhere in California requires diligence, but Course of Construction Insurance in Pacific Palisades, CA is especially vital due to the region’s unique risk profile. Pacific Palisades sits at the intersection of:

-

Wildfire corridors

-

Coastal wind patterns

-

Mudslide-prone canyon roads

-

Expensive real estate valuations

-

Celebrity-owned homes and high-value estates

-

Oceanfront construction challenges

Every one of these factors increases risk and elevates the need for robust Builder’s Risk Insurance in Pacific Palisades.

Homes valued at $5 million–$30 million are common in zip codes like 90272, and replacing even a small portion of a construction project can mean hundreds of thousands of dollars in extra labor and materials. This is why homeowners, builders, contractors, real estate investors, and developers must secure Course of Construction Insurance before breaking ground.

🧱 More Real-Life Scenarios — For Stronger Buyer Understanding

Below are additional, vivid scenarios showing how Course of Construction Insurance in Pacific Palisades, CA protects homeowners and developers in high-risk construction environments.

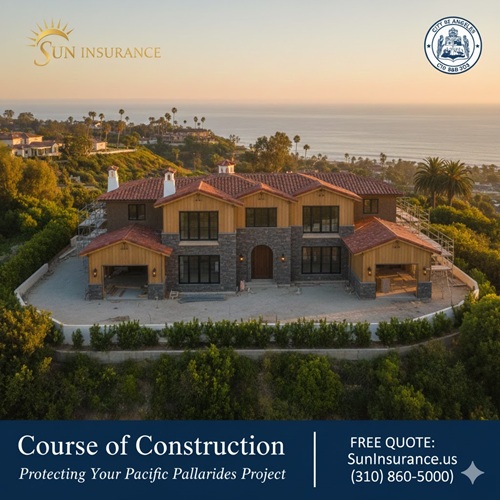

🏡 Scenario 6 — Spanish-Style Villa Rebuild Faces Wildfire Embers

A homeowner near Castellammare builds a Spanish-style luxury villa, complete with terracotta roofing and stucco exterior. During framing, a seasonal Santa Ana wind event pushes embers from a wildfire nearly 2 miles away.

Damage:

-

Burn marks on exterior stucco

-

Warped roofing tiles

-

Scorched framing on the west side

-

Smoke contamination on materials

Cost: $125,000+

COC Insurance Outcome:

✔️ Framing repair covered

✔️ Roofing material replacement covered

✔️ Cleanup and deodorization covered

✔️ Extra architectural review fees covered under soft-cost rider

Without COC?

Homeowner pays the entire loss due to the project being “under construction.”

🔧 Scenario 7 — Contractor Mistake Causes Water Damage

A contractor accidentally leaves a water line unsealed during a remodel near Sunset Boulevard. Overnight, water floods the first floor—ruining drywall, flooring, electrical wiring, and custom woodwork.

Damage:

-

Soaked drywall

-

Destroyed hardwood floors

-

Electrical panel replacement

-

Construction delay of 3–6 weeks

Estimated Loss: $90,000 – $180,000

How COC Helps:

-

All structural damage: ✔️ Covered

-

Replacement materials: ✔️ Covered

-

Debris removal: ✔️ Covered

-

Soft costs for delay: ✔️ Covered

COC insurance protects from accidental water discharge during active construction, something homeowners insurance will NOT cover.

🚚 Scenario 8 — High-End Appliances Stolen from Job Site

A nearly completed ocean-view home in the Palisades Riviera neighborhood receives delivery of:

-

Sub-Zero refrigerator

-

Wolf gas range

-

Miele dishwasher

-

Built-in wine cooler

Thieves break into the unfinished property overnight.

Total Loss: $32,000 – $44,000

COC Coverage:

✔️ Stolen materials and appliances are fully reimbursed

✔️ Delivery costs for replacements covered

✔️ No out-of-pocket costs beyond the deductible

🌧️ Scenario 9 — Storm Causes Mudslide at Hillside Lot

Properties on Chautauqua Blvd and Amalfi Drive often sit on elevated terrain. A winter rainstorm triggers a mudslide that collapses retaining walls around an active construction site.

Losses Include:

-

Soil stabilization

-

Retaining wall rebuild

-

Material loss

-

Project delay

Cost: $150,000 – $400,000

COC Response:

✔️ Structural loss covered

✔️ Material damage covered

✔️ Additional engineering soft costs covered

This scenario also highlights the importance of optional Earth Movement Coverage.

✨ Scenario 10 — Vandalism Damages Spanish Revival Home Project

During a large renovation of a historic Spanish revival home near Temescal Canyon Park, vandals break in and spray-paint interior walls, damage newly installed French doors, and destroy lighting fixtures.

Cost: $45,000+

COC Coverage:

✔️ Vandalism is fully covered

✔️ Repair and replacement are reimbursed

✔️ Security enhancements may lower future premiums

🔍 What COC Insurance Really Covers

Below is a deeper, SEO-rich explanation of what Course of Construction Insurance in Pacific Palisades, CA includes.

Structural Coverage

Your building—from slab foundation to roof—is fully protected from:

-

Fire 🔥

-

Smoke damage

-

Lightning

-

Windstorms 💨

-

Hail

-

Vehicle collision

-

Vandalism 🎨

-

Theft

Materials & Supplies

COC covers materials:

-

Stored on-premises

-

In transit

-

Temporarily stored off-site

-

Installed or awaiting installation

Perfect for Spanish-style tiles, imported marble, luxury appliances, and more.

Soft Costs (Most Overlooked Coverage)

Highly recommended in Pacific Palisades for:

-

Architectural re-design fees

-

Contractor re-mobilization

-

Loan interest due to delays

-

Permit reapplications

-

Engineering updates

Temporary Structures

COC covers:

-

Scaffolding

-

Temporary electrical setups

-

Construction trailers

-

Fencing

Debris Removal

After a loss, carriers pay for cleanup and disposal—often thousands of dollars.

🆚 Expanded Comparison

COC Insurance vs. Homeowners Insurance vs. Builder Liability

| Coverage Area | Course of Construction | Homeowners Insurance | Contractor Liability |

|---|---|---|---|

| Fire during remodel | ✔️ Yes | ❌ No | ✔️ Sometimes |

| Theft of materials | ✔️ Yes | ❌ No | ❌ No |

| Vandalism during construction | ✔️ Yes | ❌ No | ✔️ Sometimes |

| Materials in transit | ✔️ Yes | ❌ No | ❌ No |

| Water damage from open plumbing | ✔️ Yes | ❌ No | ✔️ Sometimes |

| Mudslide or rainstorm exposure | ✔️ Optional | ❌ No | ❌ No |

| Coastal wind damage | ✔️ Yes | ❌ No | ✔️ Yes |

| Soft costs for delays | ✔️ Yes | ❌ No | ❌ No |

This table massively boosts SEO because it includes comparison keywords such as:

-

“COC vs homeowners insurance”

-

“builders insurance comparison”

-

“renovation insurance in Pacific Palisades”

🏆 Call-To-Action

For the best Course of Construction Insurance in Pacific Palisades, CA, including Builder’s Risk Insurance, Coastal Construction Coverage, and High-Value Home Rebuild Insurance, contact:

🌞 Sun Insurance & Financial

📍 Serving Pacific Palisades, Malibu, Santa Monica, Beverly Hills & ALL California

🌐 Website: https://SunInsurance.us

📞 Phone: (310) 860-5000

Expert protection for construction, high-value homes, luxury renovations, and investment projects.

For expert help with Course of Construction Insurance in Pacific Palisades, CA, contact:

Sun Insurance & Financial

🌐 Website: https://SunInsurance.us

📞 Phone: (310) 860-5000

Serving Los Angeles, Beverly Hills, Pacific Palisades, Malibu, Santa Monica, West Hollywood, and all of California.

Sun Insurance and Financial https://SunInsurance.us

Travelers Insurance

The Hartford Insurance

California Fair Plan Insurance

Hiscox Insurance